It’s time to take an assessment of our achievements and create the groundwork for positive changes as we say goodbye to another year and welcome the possibilities of a new one.

Making significant financial resolutions that will impact our financial health is what could be a better way to start the year. Join me in committing to these New Year’s financial pledges to create a more stable and wealthy future in 2024.

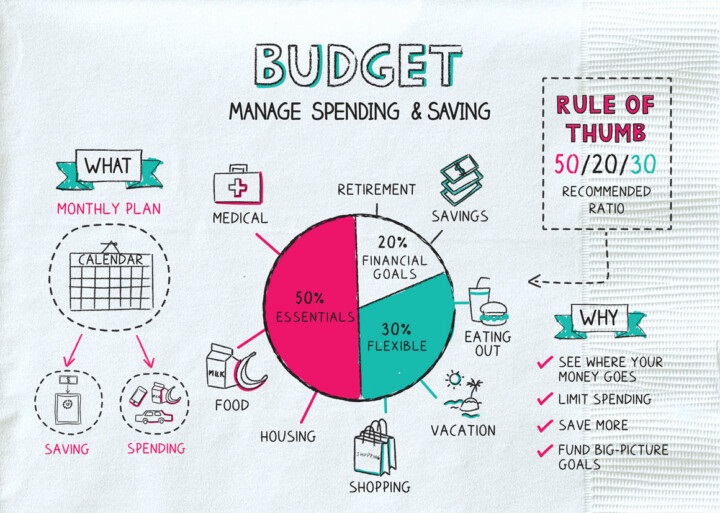

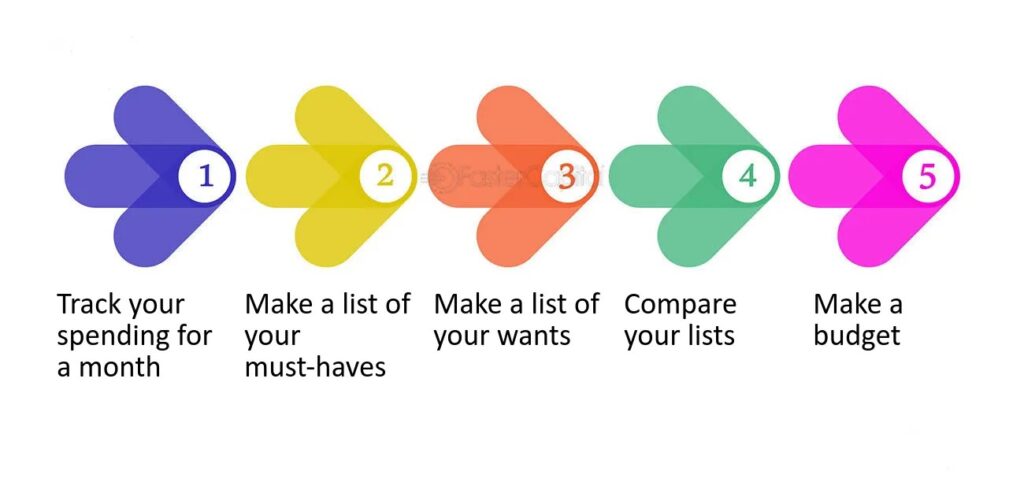

1. Update Your Budget with Purpose:- Examine your Budget again to Get Your Financial Journey started. Examine your Income, Spending, and Savings Objectives Carefully.

Do your Spending Plans and Your Financial Goals fit together?

Aim for a Budget that not only provides for your necessities but also helps you to Achieve Your Goals, making adjustments as necessary.

2. Increase Your Savings for Emergencies:– Having an Adequate Emergency Fund is your Financial Safeguard as Life is Unpredictable.

Your Emergency Reserve should be Increased to at least six months’ worth of living expenditures.

n Adequately Prepared Emergency Fund offers comfort during difficult circumstances, regardless of the need for unplanned Auto Repairs, Medical Emergencies, Job Loss, or any Emergencies.

3. Pay Off A high-interest Debt:- Take on high-interest Debt with new energy levels.

Make a list of all of your outstanding bills, rank them, and arrange a thoughtful repayment schedule. To help you manage your repayment process, think about refinancing or combining your loans.

By saying goodbye to debt, you’re opening the door to Financial Independence.

4. Make investments for the future:- Start on a Journey into the world of Investment. No matter how Experienced you are as an Investor, you can always improve your approach.

Make sure to Diversify your Investments, keep up with market developments, and keep your Long-Term Objectives in mind.

A Financially Secure Tomorrow can be Constructed with SMART Investment Decisions made Today.

5. Commitment to Regular Financial Awareness:- In the ever-changing world of Personal Finance, information truly is a Strength. Decide to dedicate yourself to continuous learning about finances in 2024.

Making Educated Financial Decisions becomes easier by remaining informed. Financial Literacy is crucial for Individuals and Families to navigate the complex world of Personal Finance and make Sound Financial Choices.

Key concepts include Budgeting, Saving and investments, Credit Management, Financial Planning, Risk Management, Understanding Financial Products, and Economics Awareness.

6. Review and Update Your Insurance Coverage:- Just as important as gaining wealth is safeguarding it. Review and update the Insurance Coverage on Regular Basis.

Make sure your Life, Health, Property, and other Assets are Adequately Covered.

Your Financial Stability Depends Heavily on a Carefully Planned Insurance Policy.

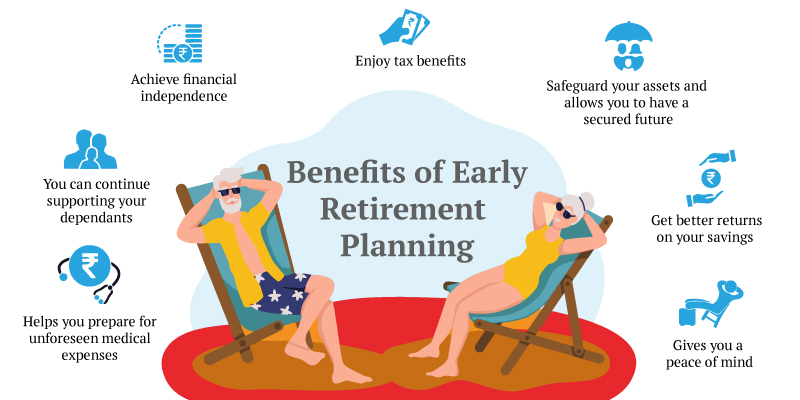

7. Build a Retirement Plan Strategy:- Planning for Retirement can be done at any time of year, whether it is a Long-Term Goal. Evaluate your present Retirement Funds, and look into Building More Money for Retirement. A stress-free and happy Retirement is Guaranteed by Planning.

Retirement planning is a vital component of Financial Satisfaction, and a Customized approach is important for Guaranteeing an Enjoyable and Safe Future.

Developing an individual and Dynamic Retirement Plan Strategy is a Process. An Enjoyable Retirement Lifestyle and Financial Security can be Achieved by Individuals through Early Planning, Regular Plan Evaluations, and Life Change Adjustment.

8. Reduce Unnecessary Expenses Carefully:- Reducing Unnecessary Expenditures doesn’t have to involve Reducing your Standard of Living.

Take a careful approach to cost-cutting. Determine which costs are not necessary, then use that money for your Financial Objectives.

It’s important to Spend Money Intelligently Rather than just Trying to Save it.

9. Develop Clear and Achievable Financial Goals:- Define your Financial Goals Specifically and Simply.

Establish Goals that Motivate and Inspire You, whether they have to do with Beginning a Business, Saving for a Dream Vacation, or Purchasing a House.

To make Greater Goals more Manageable and less difficult, break them down into smaller, more manageable steps.

10. Understand the concept of Estate Planning:- Estate planning is something that everyone should do, not only the wealthy.

Spend time writing or updating your Will, setting up Trusts, and appointing a Power of Attorney.

Estate planning gives you and your loved ones peace of mind and guarantees that your assets are transferred by your intentions.

Estate planning is an important financial strategy for people of all income levels that goes beyond money. The idea is to carefully organize your assets so that, by your wishes, they are distributed as effectively as possible both during your lifetime and after your death.

As we come to the end of our discussion on Financial Resolutions for the next year, keep in mind that your dedication to these objectives is a Commitment to yourself for a better Financial Future rather than just a quick choice. Your journey toward Financial Security will be shaped by the actions you take today, motivated by a strong sense of purpose and directed by these resolutions.

Let your Financial Resolutions be more than just Goals Written Down in 2024; rather, let them become an Inspiration for Revolutionary Deeds. Every resolve you make, whether it’s to Pay off Debt, Save for Emergencies, or Invest for the Future, has the Power to Completely Change your Financial Situation.

Accept the difficulties and successes that accompany economic expansion. Realize that challenges are only chances for you to grow and change direction. Appreciate the achievements, no matter how small, and value the path toward achieving financial stability.

Remind yourself that you are not alone when you go out on this financial adventure. Consult financial advisors for help, and be open about your achievements and challenges. Keep in mind that achieving financial security involves living a life that is in keeping with your goals and values rather than just focusing on numbers.

So let’s welcome a year filled with wise financial choices, never-ending education, and achieving your financial goals. I hope your resolutions help you navigate the ups and downs and ultimately bring you to Financial Empowerment. Let’s toast to a successful and wealthy 2024!

Cheers to a Happy New Year 2024!